The average for the 30-year fixed-rate mortgage remained below 3% this week, but economists warn that rates in the 2% range likely won’t stick around much longer. Still, mortgage rates will continue to be historically low, and slight increases aren’t likely to spook home buyers, experts said.

The 30-year fixed-rate mortgage averaged 2.94% this week, down from 2.96% the week prior, Freddie Mac reported.

“Although mortgage rates may rise in the coming months, homebuying activity won’t likely be affected,” Nadia Evangelou, senior economist and director of forecasting for the National Association of REALTORS®, writes on the association’s Economists’ Outlook blog. “Keep in mind that rates are hovering at record lows, and they will remain historically low for a longer period.” NAR Chief Economist Lawrence Yun predicts that mortgage rates will average 3.2% by the end of the year.

Low mortgage rates have helped with housing affordability at a time when home prices have surged by double-digit percentages over the past year due to increasing buyer demand. The median sales price for an existing single-family home rose to $319,200 in the first quarter of this year, registering an annual increase of 16.2%—a record high, according to NAR, which has been tracking such data since 1989. Also, housing inventory remains squeezed, pressing on demand and prices.

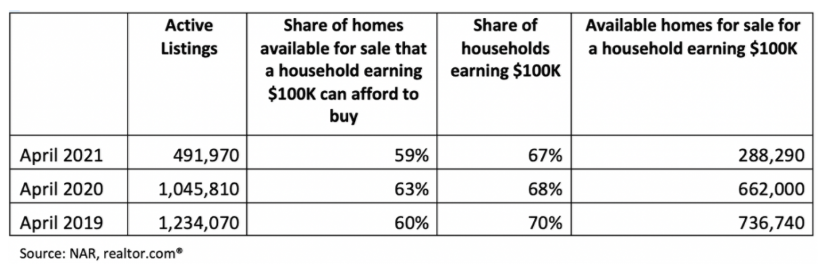

The following chart from NAR shows how many households earning $100,000 can afford to buy now versus two years ago.

Freddie Mac reported the following national averages with mortgage rates for the week ending May 13:

- 30-year fixed-rate mortgages: averaged 2.94%, with an average 0.7 point, dropping from last week’s 2.96% average. Last year at this time, 30-year rates averaged 3.28%.

- 15-year fixed-rate mortgages: averaged 2.26%, with an average 0.6 point, falling from last week’s 2.30% average. A year ago, 15-year rates averaged 2.72%.

- 5-year hybrid adjustable-rate mortgages: averaged 2.59%, with an average 0.3 point, dropping from last week’s 2.70% average. A year ago, 5-year ARMs averaged 3.18%.

Freddie Mac reports average commitment rates along with average points to better reflect the total upfront cost of obtaining the mortgage.

Source: National Association of REALTORS®