Text Version:

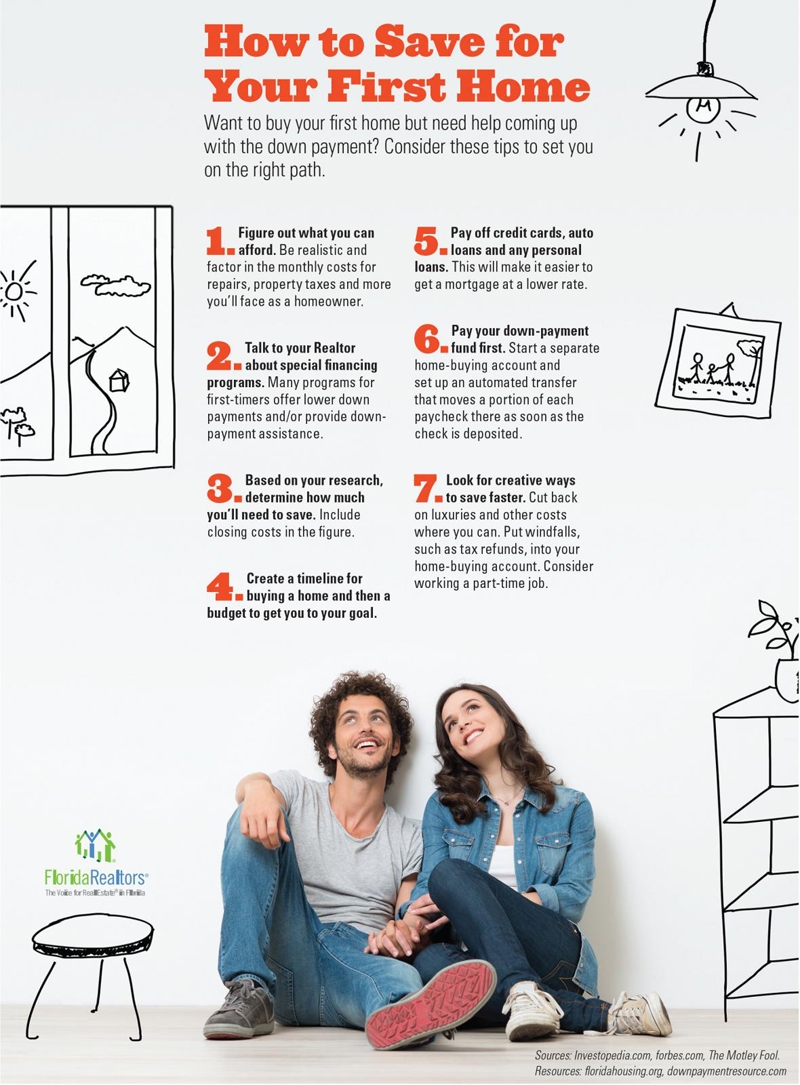

Want to buy your first home but need help coming up with the down payment? Consider these tips to set you on the right path.

1. Figure out what you can afford. Be realistic and factor in the monthly costs for repairs, property taxes and more you’ll face as a homeowner.

2. Talk to your Realtor about special financing programs. Many programs for first-timers offer lower down payments and/or provide down-payment assistance,

3. Based on your research, determine how much you’ll need to save. Include closing costs in the figure.

4. Create a timeline for buying a home and then a budget to get you to your goal.

5. Pay off credit cards, auto loans and any personal loans. This will make it easier to get a loan at a lower rate.

6. Pay your down-payment fund first. Start a separate home-buying account and set up an automated transfer that moves a portion of each paycheck there as soon as the check is deposited.

7. Look for creative ways to save faster. Cut back on luxuries and other costs where you can. Put windfalls, such as tax refunds into your home-buying account. Consider working a part-time job.

Sources: Investopedia.com, forbes.com, The Motley Fool.