In 2 out of 3 U.S. markets, it’s cheaper to buy a home than rent – but the percentage is higher in Fla., and the study cited Tampa as one of the top markets for buying.

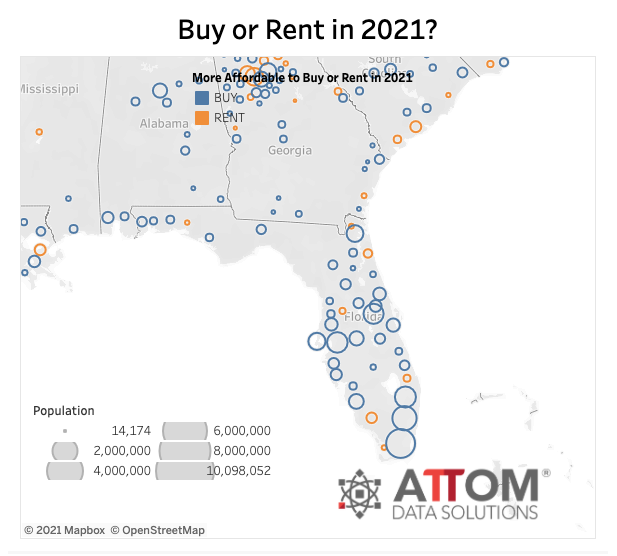

Florida map with blue circles for cities where it’s better to buyATTOM Data Solutions

NEW YORK – Homeownership is a better deal than renting, despite rapidly escalating home prices over the last few months, according to a new study released by ATTOM Data Solutions, a real estate research firm. Owning a median-priced three-bedroom home is more affordable than renting a three-bedroom property in two out of three counties (63%, or 572 counties out of the 915 U.S. counties analyzed).

Record low mortgage rates help offset some steep home price increases. Median home prices have risen more than average rents in 83% of the counties tracked.

“Home prices are rising faster than rents and wages in a majority of the country,” says Todd Teta, chief product officer with ATTOM Data Solutions. “Yet homeownership is still more affordable, as amazingly low mortgage rates that dropped below 3% are helping to keep the cost of rising home prices in check.”

Teta calls that trend “startling, but “it shows how both the cost of renting has been relatively high compared to the cost of ownership, and how declining interest rates are having a notable impact on the housing market and homeownership.”

Teta says the rent vs. buy analysis later in 2021 is uncertain, however, with COVID-19 outbreak still raging on and hampering economic growth. “But right now, owning a home still appears to be a financially sound choice for those who can afford it,” Teta says.

Homeownership was generally found to be the most affordable option in counties with a population of less than 1 million, particularly among those with less than 500,000 people, the study found. The most affordable homeownership markets tend to be located in the South and Midwest, while the least affordable tend to be located in the West and Northeast, the study notes.

The study pinpoints some of the following areas where it’s most affordable to buy than rent:

- St. Louis County, Mo.

- Pinellas County (Tampa), Fla.

- Milwaukee County, Wis.

- Marion County (Indianapolis), Ind.

- Shelby County (Memphis), Tenn.

Source: ATTOM Data Solutions

© Copyright 2021 INFORMATION INC., Bethesda, MD (301) 215-4688